Customer Services

Copyright © 2025 Desertcart Holdings Limited

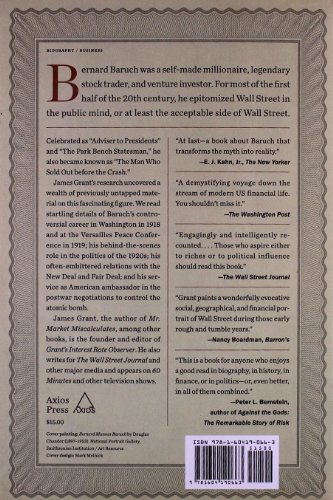

Bernard Baruch: The Adventures of a Wall Street Legend

M**E

How the US went from laissez-faire to state control in one biography

Anything James Grant writes is worth reading. This one is no different. What is special about Grant's writing in works such as this is his love-hate relationship with his subject and his description of the time as much as the person. Baruch made his millions speculating in the stock market and went on to be an advocate for government regulation of the economy (albeit aghast at what that led to in FDR's hands). Or, as Grant puts it, "Having made a fortune in Wall Street under a system of low taxes and limited government, Baruch entered public life to help install a regime of relatively high taxes and intrusive government."Baruch's perspective could be summed up in this quote: "I have unlimited faith in the American people taking care of themselves--if they are told what to do and why." A nice bundle of contradiction. But Baruch epitomizes the early 20th Century leader, self-made and so sure he knows everything he is eager to tell others what to do, the Government being a fitting tool for that purpose. Baruch's favorite work was as de facto national quartermaster of industry during WW1.There is a great outline of Baruch's general method of investment (although little description of specific investments he made) -- "A memo to himself on the basics of investment and speculation" (~1930), which include gems such as:"Become more humble as the market goes your way""It is not prudent to buy when you think the bottom has been reached. It is better to wait and see and buy too late.""A determination to make a certain amount within a certain time absolutely destroys pliability (anti-cockiness).""When the market is high beware of thinking of things that will make it go higher."Baruch avoided destruction in the Crash by not overextending on margin and resisting "the temptation to buy stocks heavily before the liquidation had run its course."Grant's writing is rich with fantastic quotes, such as these:"in the Crash, prices had fallen like hailstones. In the long ensuing liquidation they floated to earth like leaves. Watching them, people were ruined.""The seismic bull market that posterity associates with exuberance, credulity, and wealth was also a source of disbelief and losses among professional traders who had been given to understand that speculative trees didn’t grow to the sky.""I think economists as a rule...take for granted they know a lot of things. If they really knew so much, they would have all the money and we would have none." (So you have to appreciate Baruch's practicality)."You don't distribute wealth. You distribute poverty." (Baruch)"It all seemed as amazing to him as if he were describing someone else, or as if it had happened the day before." (A journalist describing Baruch talking about himself "standing in awe of himself")

T**G

A Fascinating Player in the Evolving Stock Market and Governmental Economic Policies During Wars, Depression, and Prosperity

For decades I carried this mental picture of the "Bench Park Philosopher" Bernard Baruch, probably from Life magazine in the 1950s. Little did I know how much his journey through life read like a real life Forrest Gump. Emergency stock exchange: Baruch was there; League of Nations: Baruch was there; Major economic decisions: also there. And the list goes on.This well-documented book is a easy read for anyone who has an appreciation for the individuals who made a difference in our nation's travails and successes for a large portion of the 20th century.

M**N

Not bad but not great

Grant is a better newsletter writer than a biographer. The book is overly long IMO and way too much time is spent on his service at the Versailles Peace negotiations and subsequent involvement in democratic politics/government affairs. Baruch was famous for his speculation and wealth which is well covered but only makes up 2/3’s of the book!

N**R

I thoroughly enjoyed Bernard Baruch

I thoroughly enjoyed Bernard Baruch: The Adventures of a Wall Street Legend, by James Grant. Baruch was mentioned in my American history textbooks in the 1960s, so I was always aware of his importance. And what a varied and distinguished career! Baruch was a self-made millionaire whose moves were closely followed on Wall Street. Grant’s background in finance and as an author provided him with the perfect background to write this biographer, and he does not disappoint. Grant traces – and explains – Baruch’s investment decisions, the research that proceeded those decisions, and places all this in the context of the market and macro-economy of the era. Grant is masterful as he explains why and how Baruch took long and short positions on stocks, how had won, and how he sometimes lost.Grant does an equally fine job in tracing Baruch’s service as head of the War Industries Board in World War One, and in detailing the political intrigue of the decades that followed his 1917 departure from the New York Stock Exchange. That includes Baruch during the Roaring Twenties, the Great Depression, World War Two, and the remainder of his life. And do you want to know how Baruch worked with, and advised, presidents such as Woodrow Wilson, FDR and JFK, and his good friend Winston Churchill? It’s all here.This is a book that should be on the reading list of every high school and college student, and is a perfect blend of information and enjoyment. Don’t miss it!

C**E

Five Stars

ok

A**N

interesting life

The first half of the book is great, but I guess like baruch's life, the 2nd half wasnt as interesting.written with the same wit and charm grant is known for.I found a used copy for <$5. Cant beat that!

A**T

the great depression, and WW2

Baruch was more than a wall street wizard...a confidant to presidents advisor toworld leaders served in various cabinet and committee positions. The book alsodepicted Mr.Baruch's tremendous insight with regard to the political and economical aspects leading up to WW1, the great depression,and WW2.Bert

S**Y

Genius

A biography of a genius, written by a genius

J**I

limited help in understanding his trades

Not the fault of the author because data are limited, but the book runs out of details in terms of his trades and talks a lot about politics and beurocracy, which admittedly were a large part of his life. You do get to read about two or three interesting plays in the market, however.

A**L

Four Stars

very interesting book... definitely not mind candy!

A**V

Did not like this book

Boring book

S**Y

little slow, too much detail. short version would ...

little slow , too much detail. short version would have been interesting.

J**B

Five Stars

A worthwhile read

Trustpilot

2 weeks ago

1 week ago