Customer Services

Copyright © 2025 Desertcart Holdings Limited

Desert Online General Trading LLC

Dubai, United Arab Emirates

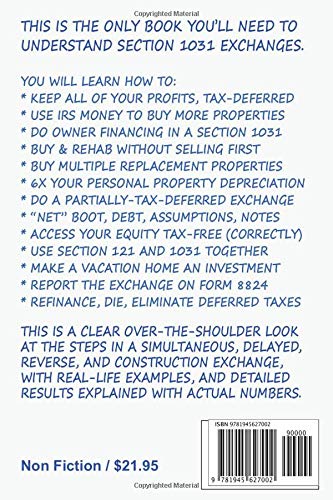

How To Do A Section 1031 Like Kind Exchange: Simultaneous, Delayed, Reverse, Construction

B**G

Ten Star Rated Book for 1031 Process

As a professional in this world, I have never read such a clear and articulate explanation of the Section 1031 process.I ordered four books on this subject area and this one was clearly the best in my opinion. For these books to be useful they must be up to date, not all printed resources are. One Loophole book was over 15 years old and never updated to my knowledge for the latest revisions to the tax code. In fact the pages were yellowing from old age, but being sold as if it was new and up to date. I promptly returned the book.This book has been updated to 2020 interpretations of the most recent IRS rulings and court proceedings. Factual, no nonsense, no ambiguous waffling. Clear explanation of potential pitfalls and warnings of the scammers out there taking advantage of the less well informed. Absolutely a must buy if you are even contemplating and wondering if this tax/investment strategy is worth considering. The introduction alone establishes the Ethos of the writer and his writing style. His experience and knowledge illustrates clearly he has sat on every side of the table. From being a Tax examiner for the IRS, Lawyer, former owner of a title company, approved Title Attorney for several national Title Insurance Underwriters, the list goes on. The bottom line is I do not believe there is a better resource published to guide you through the 1031 process. Finally the book makes its clear you should never attempt such a transaction without the proper experienced professionals on your team.The book will allow you to evaluate effectively the professionals you invite onto your team and help ensure a satisfactory outcome. One that does not draw attention from the IRS because you have followed the rules and stand clearly on the side of prudent caution in your execution of the transaction. Well done Michael Lantrip

G**G

EVERYONE DOING A 1031 SHOULD READ THIS BOOK

I have done a few 1031 exchanges over the last couple of decades, and may be doing an extremely complicated one in the next year or so - so decided to buy this book. First, a review of the overall content: It is very well laid out, builds from one chapter to the next in order for people unfamiliar with 1031 exchanges not to be overwhelmed. Gives several examples of fairly common scenarios that a typical investor will run into doing an exchange. The book did help me with some aspects of my potential upcoming exchange, but fell short - probably because mine is so complicated. The point being, if you have a typical exchange you should buy this book ASAP and save money. If you have something that is off the deep end complicated, it is helpful, but won't answer all the questions. There were a few things that I thought could have been added, or made clearer: 1) The 2009 change to IRC 121 - buying an investment property then later making it your primary residence, there are tax consequences there. 2) That you can mitigate RE long term capital gains via tax harvesting common stock capital gain losses. 3) A new scenario should be added with the advent of the 'sharing economy' where people are renting out part of their home via AirB&B, or VRBO. This will become a more common issue that will need to be addressed in the future. This is somewhat addressed under the mixed use scenario, but not sure everybody would understand that.Overall, great book. Could use a couple of tweaks/additions, and the author does update it on a regular basis so these updates may already be in the works.

R**R

An Absolutely Phenomenal Guide to Increasing Your Profit!

In my opinion, this book is the GO TO book for real estate investing if you are considering a Section 1031 Exchange and, in addition, it’s the best business tax guide you will find for how to defer capital gains tax.The 1031 Rules are explained in plain English, and the explanations for things like depreciation and refinance are easy to understand.For the money, this book is by far the best investment I've made when trying to understand complicated legal issues like a Section 1031 exchange.Understanding the concepts laid out in this book could turn that “No way” investment decision into an “Absolutely” when you see how this method can add an extra 30% to your overall profit.The author’s credentials are outstanding, and the book is very well written. While I expected it to be another of those full of legal jargon, the author has done a phenomenal job of breaking this down into simple, easy to understand examples and concepts. There are a lot of areas of the law like this and I hope Mr. Lantrip continues to write!

D**Z

Great resource for the basics and the nuances of 1031 exchange

I've been toying with performing a 1031 exchange for the past few years. I am now getting more serious about going through with it. I've made myself somewhat familiar with the process, and reading this book solidified this basic knowledge. The author also explains other aspects and nuances of the process which I hadn't even considered. Though short, the book is well-written, up-to-date, and filled with useful information. I now feel much more confident in proceeding with the next steps in this process.

V**A

Great Info

Just finished the second book I purchased from Michael Lantrip. Glad that I read it also as I picked up some additional great tips. Am doing my first 1031 exchange later this month and feel much more confident and I have an up-to-date and thorough understand of the necessities. I highly recommend this book. I feel it is a must read, not only for someone doing their first but some an experienced exchanger learning the most current information.

M**M

Sorry. It is too basic.

Lots of words, little content.

Trustpilot

2 days ago

1 week ago